Gold, Silver, and Forex Market Analysis Amid Tariff Pause

Market Analysis GOLD GOLD prices surged ahead of Trump’s tariff announcement. During yesterday’s trading session, there was a notable increase in volume, pushing gold prices higher. This movement was likely driven by profit-takers re-entering the market after prices dipped to premium levels. Earlier today, Trump announced a 90-day pause on

Current U.S. Tariff Conditions & Market Impact

Market Overview Implemented Tariffs Reciprocal Tariffs (Effective April 9, 2025) Planned Tariffs by Other Countries These tariff changes are shaking global markets. The fast-moving nature of these new trade policies has led to significant market volatility and the potential for a broader trade war. While the U.S. is looking to

Tariffs Shake Forex Market: Full Pair & COT Analysis

Market Overview With the recent escalation in global trade tensions, market volatility has surged. Countries are responding to U.S. tariffs, with several imposing reciprocal duties on American goods. As of April 2025, a 10% tariff is applied to nearly all imports into the U.S. (excluding Canada, Mexico, and Belarus). A

Tariff Volatility: Gold Drops & Forex Pairs React Sharply

Market Overview The latest U.S. tariff implementations are shaking global markets, triggering intense volatility. Key measures include a 10% baseline tariff on all imports (excluding Canada, Mexico, and Belarus), a 25% tariff on non-USMCA-compliant automotive imports, and increased aluminum and steel tariffs under Section 232. Additionally, reciprocal tariffs are targeting

Tariffs, Gold, & Forex: Market Reaction & Trade Outlook

Market Overview Trump’s newly announced trade tariffs have sent shockwaves through global markets, prompting investors to seek safer assets. The universal 10% tariff on all imports and reciprocal tariffs on 60 countries have created immediate ripple effects across commodities and major currency pairs. As import costs rise, concerns over inflation

Gold, Silver & Forex Majors: Tariff Impact Market Outlook

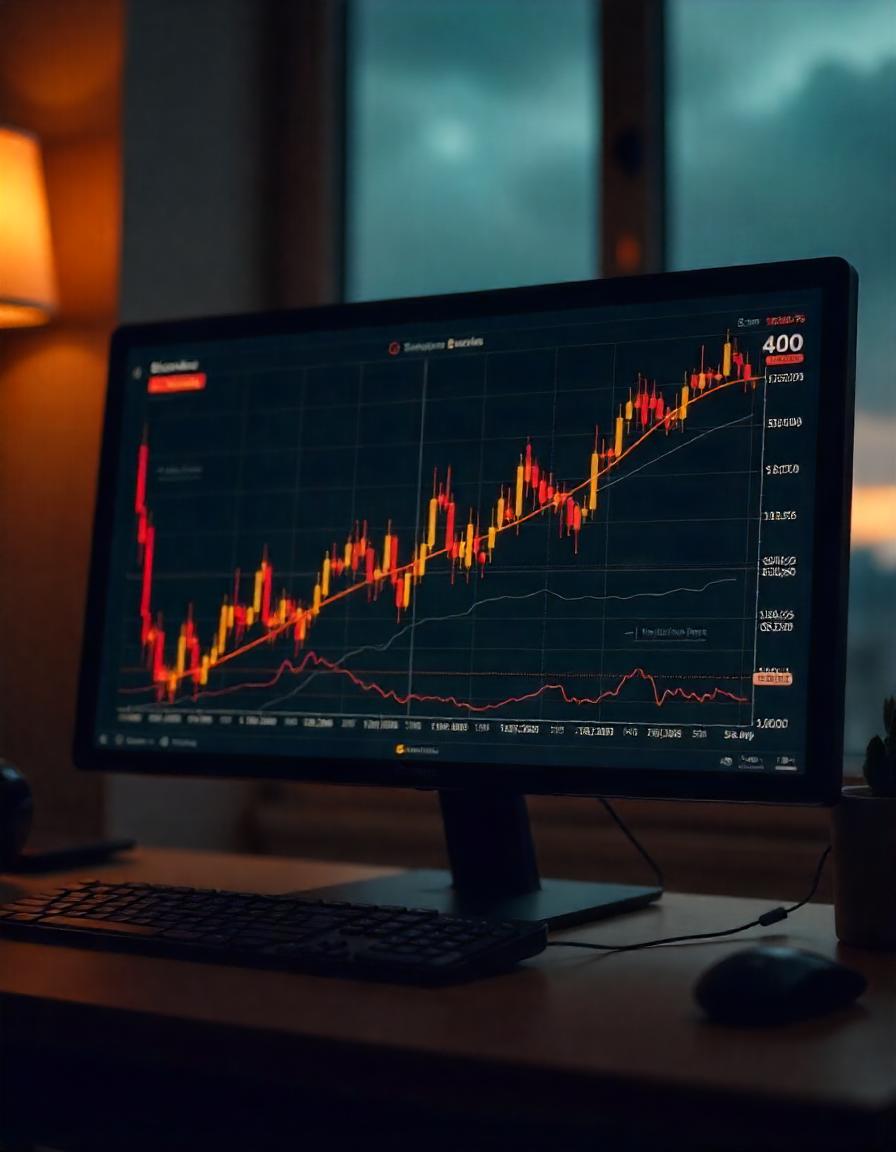

GOLD Gold prices are showing increased potential for a bullish continuation, as recent economic indicators suggest growing uncertainty in global markets. Despite heavy selling, the MACD reveals surging bullish volume, and price action remains resilient. The RSI approaches overbought territory, signaling possible consolidation—but with strong bullish engulfing patterns on the

Market Outlook: Gold, Majors & Breakout Trade Setups

GOLD Gold prices surged significantly today, aligning with broader market expectations and recent economic indicators. As Trump’s tariff plans take center stage, investor sentiment is leaning toward safe-haven assets. The MACD, although crossing lower, is showing increasing bullish volume—suggesting strong buying pressure beneath the surface. The RSI remains sideways, yet

Gold Prices Surge, Dollar Faces Selling Pressure Amid Tariffs

Market Analysis: Focus on Trade Tensions and Geopolitical Risks Gold continues its ascent, driven by ongoing trade tariff discussions and geopolitical factors. Meanwhile, the dollar faces selling pressure, and other currency pairs like GBP/USD and EUR/USD show signs of increased bullish momentum. As market volatility increases amid tariff-related concerns, traders

Gold Breaks Out, Silver Follows; USD Faces Consolidation

GOLD Gold has broken through its consolidation zone, setting new all-time highs. Geopolitical risks and rising global trade tensions are driving demand for gold. The market may experience short-term retracements, but the long-term outlook remains bullish. SILVER Silver has followed gold’s lead, experiencing increased buying pressure. The MACD shows strong

Gold and Silver Prices Face Selling Pressure, Dollar Strengthens

GOLD Gold prices have remained steady, but with signs of slowing momentum. The MACD and RSI indicate weakening bullish strength, with potential for a short-term retracement. The market is cautious as it awaits news on the U.S. administration’s tariffs. We maintain a bullish outlook long-term but are awaiting a clearer